The Dwarka-Gurgaon Expressway, also known as the Northern Peripheral Expressway, is set to become a hotbed for real estate investment with significant growth potential in the coming years.

Bangalore is emerging as a new investment hub, fueled by the IT and BPO sectors, transforming into a self-sufficient city with growth potential.

Dalmia Group’s Landmark exits Wave Group's Ghaziabad project, earning 3.16 times its initial investment of Rs 111.26 crore amidst market slowdown.

Bhiwandi, Rajasthan, is emerging as a promising affordable housing hub due to its strategic location, industrial growth, and infrastructure development. It's becoming a sought-after area.

The real estate market, once a high-growth sector, is currently facing challenges due to economic slowdown and revised funding rules. Experts advise caution and research before investing.

Real estate investment requires careful consideration of funding, location, and developer reputation. Long-term investment strategies are advised, given the average annual price growth of 12-15% in major Indian cities.

Xander is poised to acquire 100% stake in an IT SEZ from Shriram Group for ₹690 Cr, having signed an initial agreement. The 2.5-million sq ft tech-park mostly leased.

Private equity firms are partnering with established real estate developers to create large assets and ensure stable returns, even as overall transaction numbers decrease. This trend is expected to grow.

Mumbai commercial realty outperforms NCR, offering higher investment returns, according to Knight Frank. This is attributed to favorable business conditions, talent access, and connectivity.

IIFL to raise 2 new real estate funds for residential & office space projects

Real estate investment in Uttar Pradesh surged 106% between 2008-09 and 2012-13, attracting Rs. 14,000 crore and ranking sixth nationally, according to ASSOCHAM.

India's realty investment fell sharply, with only Rs.42,000 Cr invested, down from Rs.92,600 Cr in 2012, according to ASSOCHAM.

Meydan Group and Lodha Developers Ltd will collaborate to develop a $5.7 billion residential project in Dubai's Mohammad Bin Rashid City, featuring 1,500 homes and various amenities.

Despite facing regulatory challenges, Sahara Group has purchased approximately 25 acres of land in Whitefield, Bangalore for ₹149 crore, with plans for commercial or hotel development.

Soaring property prices deter buyers, leaving developers with unsold inventory and financial struggles. Major cities face declining sales, impacting developers like Mantri Realty.

With the decline in gold prices, investors are opting for gold over real estate, causing a shift in investment patterns.

Valmark Group, a Bangalore-based real estate company, is considering raising a private equity real estate (PERE) fund of ₹125 Cr focused on Bangalore's realty market.

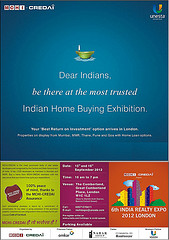

The MCHI-CREDAI Property Expo 2013 in Mumbai has seen a huge turnout of buyers, indicating robust interest despite market challenges, showcasing over 15,000 properties.

SEBI questions Subrata Roy Sahara and 3 other Sahara directors over asset details

Jones Lang LaSalle plans to raise Rs.1200 Cr for investment in the commercial realty sector.

The Indian Property Show in Doha anticipates 5,000 attendees. Showcasing 200 projects from 50 top developers, NRIs can explore diverse housing options, from affordable to luxury, connecting directly with industry experts.

India holds the 20th position in global real estate investment, with $3.4 billion received last year, signaling potential growth in 2013.

JLL to invest Rs. 30 crore in two Bangalore luxury housing projects from its Rs. 300 crore India-focused real estate fund, capitalizing on the city's stable residential market.

Commercial property investment is most lucrative in major cities with robust infrastructure, better connectivity, and higher rental appreciation compared to tier-II cities.

The demand for office space in India is set to rise as foreign retailers like Starbucks and H&M expand their operations in major cities.