South Goa's premium apartments are revolutionizing real estate investment with 8-12% growth potential, modern infrastructure, and compact living appeal for urban buyers.

Master Gujarat's property tax calculations for Ahmedabad investments. Learn assessment methods, exemptions, and save money on residential and commercial properties.

Discover lucrative commercial property investments in Calangute and Arpora, North Goa's hottest rental markets offering 8-10% annual returns for savvy investors.

Gandhinagar's proximity to educational institutions like PDPU and IIT creates unprecedented rental demand, offering investors lucrative returns in student housing market.

Ghaziabad's real estate transformation accelerates with Delhi-Meerut Expressway, RRTS corridor, and metro expansions driving 73% price surge in key localities like Indirapuram.

Wagle Estate transforms from 1962 industrial zone into Mumbai's next commercial powerhouse, blending residential and office spaces with metro connectivity.

Complete guide to Mumbai property due diligence covering MahaRERA verification, title checks, developer assessment, and infrastructure impact for safe 2025 investments.

Comprehensive guide to government-backed affordable housing programs, subsidies, and low-cost financing options available for homebuyers in Zirakpur real estate market.

Comprehensive legal guide for NRIs investing in Navi Mumbai properties covering FEMA regulations, tax implications, acquisition processes, and repatriation challenges.

Discover how Hyderabad developers are creating 2,000+ sq.ft. homes with integrated gyms, private balconies, and advanced security systems while maintaining competitive pricing.

Strategic insights on evaluating metro routes and highway upgrades to maximize property investment returns through improved connectivity and transportation access.

Panchkula's Rs 587.94 crore infrastructure budget drives property values up 18-22% with AI-powered ICCC, smart traffic systems, and modern civic amenities transforming urban living.

Mumbai's real estate shows stark contrast - luxury properties above ₹5 crore surge 7% while mid-range ₹1-5 crore segment declines, creating unique investment opportunities.

Discover how new retail developments and shopping centers in Zirakpur create a powerful synergy that's driving unprecedented residential property demand and investment growth.

Explore how Rajkot's real estate market transformed post-COVID, with buyers prioritizing 4+ BHK homes featuring dedicated workspaces over compact units.

Discover how NRIs can navigate Kolkata's booming luxury property market in 2025, exploring investment strategies, legal processes, and emerging opportunities.

Explore how smart technologies like IoT security, energy management, and home automation are revolutionizing Hyderabad's residential projects, creating tech-enabled communities.

A comprehensive guide to understanding RERA compliance in Mohali, avoiding common pitfalls, and verifying developer credentials for safe property investments.

Master ROI calculations for residential investments in Ghaziabad's growing sectors. Learn rental yield, capital appreciation, and resale value estimation techniques.

Explore how migration from Hyderabad's core to Ranga Reddy suburbs creates India's richest district, driving luxury housing demand and reshaping real estate dynamics.

A comprehensive guide covering stamp duty, registration processes, GST implications, and recent policy changes for North Goa property buyers and investors.

Discover how proximity to quality schools in Thane significantly influences property values, with family-oriented buyers driving 15-35% price premiums in education-rich neighborhoods.

Strategic guide for Mumbai property buyers to optimize stamp duty costs through smart timing, negotiation tactics, and understanding recent market revenue trends.

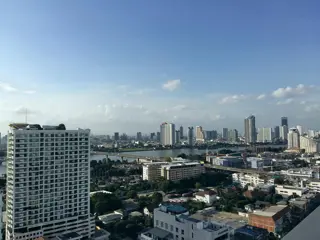

Navigate Kolkata's luxury riverfront real estate with expert insights on location assessment, amenities evaluation, and investment potential for premium waterfront properties.

Navigate Kolkata's booming property market with strategies to maximize both investment returns and rental income in areas showing 37% annual growth.