Union Minister Nitin Gadkari criticizes cement factories for price hikes, citing challenges for infrastructure projects

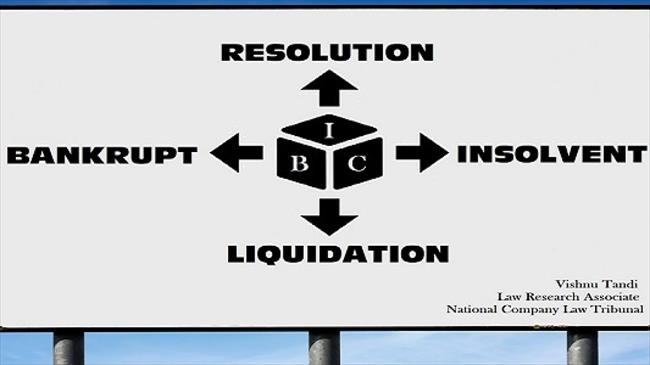

The finance ministry is considering waiving the 21-day national lockdown period from the bankruptcy resolution process due to COVID-19 outbreak, potentially extending it further.

Hotels and convention centers are now included in the master list of infrastructure, a move praised by the Tourism Minister which is likely to boost the hospitality sector.

India's Finance Ministry is finalizing rules for a new Infrastructure Trust Fund to accelerate investment in power, ports, and aviation projects, aiming to attract domestic and foreign investors.

Indiabulls Housing reduces home loan rates by 0.15% to 10.25%, valid till November end for loans under Rs 25 lakh.

Finance ministry officials and RBI plan to meet to discuss relaxing external commercial borrowing norms to enhance affordable housing projects in India.

Budget 2013-14, announced by Finance Minister P. Chidambaram, introduces mixed measures impacting both high earners and common taxpayers, with changes in tax structures, luxury items becoming costlier, and benefits for first-time home buyers.

Union government may confer infrastructure status to housing sector in upcoming budget, aiming to provide affordable homes and boost supply.

Budget 2013 is anticipated to favor home buyers, with potential provisions for affordable housing. Realty players seek tax exemptions and lower interest rates.

Finance Ministry proposes that real estate firms and brokers be permitted to operate banks, with regulations to prevent conflicts of interest and mitigate risks.

Finance Ministry plans to bolster the real estate sector by facilitating bank loans for builders with stalled residential projects, aiming to revitalize the sector and stimulate economic growth.

RBI's decision to hold key policy rates steady has disappointed real estate developers, who were hoping for a reduction in borrowing costs. Industry leaders believe this will negatively impact the sector and hinder funding for projects.

Govt to sell/lease surplus land to ease financial stress, boosting real estate growth in Indian metros.

India's real estate prices expected to rise further as Finance Ministry retains 2.5% service tax on under-construction projects, impacting homebuyers.

CREDAI submits memorandum to Finance Ministry to remove service tax on under-construction housing complexes.

The urban development ministry calls for a review of the proposed service tax on housing projects, amidst concerns over its impact on the struggling real estate sector.

The finance ministry has dismissed RBI's concerns about real estate mutual funds (REMFs) violating FDI norms, potentially opening new investment avenues in the real estate sector for small investors.