Impact of National Lockdown on Bankruptcy Resolution Process

MUMBAI: In an initiative aimed at ensuring the smooth resolution of distressed firms, the finance ministry is considering waiving the 21-day national lockdown from the bankruptcy resolution process, taking into account the hardships faced due to the nationwide lockdown. Sources familiar with the matter also indicated that the waiver period could be extended in line with the duration of the national lockdown.

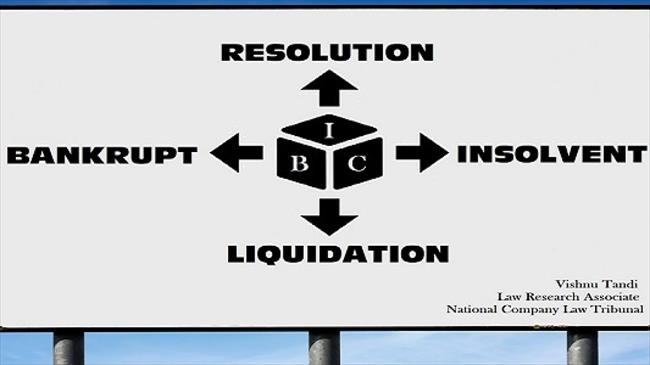

Under India’s Insolvency and Bankruptcy Code, firms facing bankruptcy have 270 days to complete the resolution process. Despite the timelines stipulated in these regulations, the period of lockdown imposed by the Central Government following the COVID-19 outbreak will not be counted for the purposes of the timeline for any action that could not be completed due to the lockdown.

Finance Minister's Quote

The finance minister has recently stated that if the disruption caused by the coronavirus pandemic continues, the application of the corporate bankruptcy resolution process could be suspended for some time. Additionally, the finance minister increased the threshold amount of default required to initiate insolvency resolution and liquidation proceedings against companies from one lakh rupees to one crore rupees.

Challenges and Expert Opinions

"In terms of ongoing IBC processes, delays are inevitable as the investing community is expected to be more cautious about their offers and in many cases whether to bid at all – due to the lockdown. The best of businesses are focusing on cash protection, and this presents a significant challenge for the insolvent companies and their Resolution Professionals (RPs). Extension in the bid process is a major scenario, and we anticipate it should be complemented by an extension of the RP period," stated Sanjeev Krishan, Partner and Leader – Deals, PwC India.