Maxxed Realtor, a Gurgaon-based real estate advisory firm, launches Maxxed.in to expand services to NRIs. The user-friendly website offers information on various investment options, including projects by IREO, DLF, Tata, and Adani.

Mahanagar Telephone Nigam Limited (MTNL) plans to raise Rs.5000 Cr by divesting real estate assets in Delhi and Mumbai, enlisting global consultancy DTZ for support.

The real estate market shows a steady increase in cash flows, which offers builders hope to pay off their debts. The sector is revised from 'negative' to 'stable.'

Mantri Group wins the CII-ITC Sustainability Award 2012 for their commitment to sustainable development, presented by President Pranab Mukherjee in New Delhi.

ICICI Venture, a major Indian private equity firm, secured approximately $700 million last year through real estate and other funds. The firm plans further investments in key Indian cities.

CapitaLand to Exit Indian Real Estate Market, Plus UK and Australia

MIDC's new industrial policy allows 40% of SEZ land for residential projects, potentially generating ₹3.08 lakh Cr in revenue and boosting industry growth in Mumbai.

Odisha real estate builders fear market slowdown due to recent scams. CREDAI-Odisha Chapter forms scrutiny committee to restore trust.

Real estate shares are under significant selling pressure due to high inflation and interest rates, with notable declines across major companies like DLF and Unitech.

DLF, India's largest real estate company, plans to reinvest in Delhi's real estate market after selling its stake in Aman Resorts. This move aims to reduce debt and refocus on core business, with new projects expected within four months.

Haryana CM Bhupinder Singh Hooda's relatives have extensive real estate dealings, raising concerns over close ties between politicians and real estate corporations amidst allegations of misconduct.

India's real estate market deemed 'investor unfriendly' by UK's RICS due to high land prices and property costs.

Anil Ambani's Reliance Group partners with China's Dalian Wanda Group to develop real estate projects in Mumbai and Hyderabad, marking the first Chinese real estate investment in India.

CREDAI urges real estate developers to lower property prices to address high unsold inventory, amidst suggestions from Finance Minister P Chidambaram for economic revival.

The real estate sector faces labor shortages, leading to exploitation of migrant workers in India, often forcing them into bonded labor and crime.

Robert Vadra Cleared in Real Estate Land Scam, PMO Declares Him Innocent.

Real estate builders are turning to online reputation management systems to address negative comments from home buyers on social media due to project delays.

Gammon India, grappling with financial losses and a substantial debt of Rs. 3200 Crore, is monetizing real estate assets due to high financing costs. The company looks to reduce debt.

Indiabulls Real Estate Ltd. is opening its first overseas office in the UAE to assist UAE NRIs in property investment. The company plans expansion to Qatar, Saudi Arabia, and Bahrain.

Global sports icons like Maria Sharapova and Michael Schumacher are endorsing real estate projects in India, aiming to attract high-end clientele and rejuvenate the market.

Ponty and Hardeep Chadha, real estate moguls, were killed during a property dispute at their farmhouse, leading to police arrests of implicated security personnel.

Air India plans to monetize its real estate assets, including properties in Delhi, Mumbai, Chennai, London, and Tokyo, to address its financial challenges and raise around Rs. 5,500 crore over the next ten years.

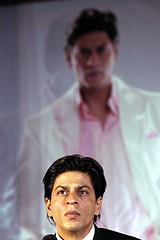

Bollywood superstar Shahrukh Khan has become the brand ambassador for NCR-based real estate developer Mahagun, marking his first endorsement in the real estate sector.

CREDAI urges faster environmental clearances to meet the rising housing demand. Lalit Kumar Jain highlighted project delays due to the Ministry of Environment.

Real estate Private Equity firms face liquidity issues due to demands for increased transparency from investors. This situation is seen globally, not just in India.