The outbreak of coronavirus, originating in Wuhan, China, and its subsequent spread to the Delhi-NCR region has drastically altered business landscapes. It is anticipated that the Indian real estate sector will be indirectly impacted as several sectors, including steel and heavy machinery, heavily rely on imports from China. As of April 10, 2020, over half a million individuals globally have become infected, and more than 96,000 have tragically lost their lives due to the virus. With the World Health Organization (WHO) labeling it a global health emergency, the economic circumstances have faced significant challenges. The ramifications of this outbreak have created considerable uncertainty surrounding both trade and imports, affecting not just China but the entire world, leaving the real estate market vulnerable to these changes. Consequently, we can expect an immediate influence on the prices of steel and other materials crucial for construction in India. Impact on Commercial and Retail Real Estate in India Though India has, thus far, experienced lesser impact from the Novel Coronavirus compared to East Asia, the rapid spread of the infection across the country is undeniable. The real estate sector is rightfully worried, as experts suggest that the industry will undergo unintended impacts due to its heavy reliance on imports from China. The present surge in COVID-19 cases has led to a decline in retail consumption, as people increasingly choose to maintain social distance from crowded venues like entertainment hubs and shopping malls. While the health and safety of employees remain a primary concern for many corporates, firms are now more focused on workplace sanitation, implementing remote work policies, and adopting flexible workspace solutions. Effects of the Coronavirus Outbreak on REITs Recent analyses indicate that the consequences of the COVID-19 outbreak will pose a significant hindrance to planned investments and fundraising pursuits through Real Estate Investment Trusts (REITs) this year. Any forthcoming fundraising initiatives via REITs are likely to be postponed until the pandemic subsides. Koshy Varghese, MD of Designbuild Pvt. Ltd., expressed that the shutdown's effects are beginning to emerge within the real estate investment market, noting that meeting objectives is becoming a significant concern for all stakeholders involved.

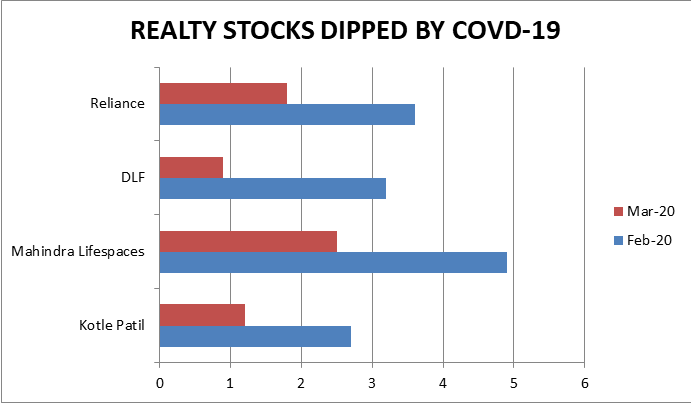

The outbreak of coronavirus, originating in Wuhan, China, and its subsequent spread to the Delhi-NCR region has drastically altered business landscapes. It is anticipated that the Indian real estate sector will be indirectly impacted as several sectors, including steel and heavy machinery, heavily rely on imports from China. As of April 10, 2020, over half a million individuals globally have become infected, and more than 96,000 have tragically lost their lives due to the virus. With the World Health Organization (WHO) labeling it a global health emergency, the economic circumstances have faced significant challenges. The ramifications of this outbreak have created considerable uncertainty surrounding both trade and imports, affecting not just China but the entire world, leaving the real estate market vulnerable to these changes. Consequently, we can expect an immediate influence on the prices of steel and other materials crucial for construction in India. Impact on Commercial and Retail Real Estate in India Though India has, thus far, experienced lesser impact from the Novel Coronavirus compared to East Asia, the rapid spread of the infection across the country is undeniable. The real estate sector is rightfully worried, as experts suggest that the industry will undergo unintended impacts due to its heavy reliance on imports from China. The present surge in COVID-19 cases has led to a decline in retail consumption, as people increasingly choose to maintain social distance from crowded venues like entertainment hubs and shopping malls. While the health and safety of employees remain a primary concern for many corporates, firms are now more focused on workplace sanitation, implementing remote work policies, and adopting flexible workspace solutions. Effects of the Coronavirus Outbreak on REITs Recent analyses indicate that the consequences of the COVID-19 outbreak will pose a significant hindrance to planned investments and fundraising pursuits through Real Estate Investment Trusts (REITs) this year. Any forthcoming fundraising initiatives via REITs are likely to be postponed until the pandemic subsides. Koshy Varghese, MD of Designbuild Pvt. Ltd., expressed that the shutdown's effects are beginning to emerge within the real estate investment market, noting that meeting objectives is becoming a significant concern for all stakeholders involved.  There have been substantial losses evident in real estate stocks following the coronavirus outbreak. (Source: https://www.moneycontrol.com/) Safety Measures Implemented by Builders and Employees for Homebuyers and Workers Amidst such turmoil, traditional real estate practices have become a delicate balancing act, as real estate professionals strive to administer their responsibilities while ensuring the safety of their employees and clients. These measures include enforcing rigorous hygiene protocols within their premises, implementing social distancing, and even canceling events. Many builders have already instituted precautionary steps to ensure the safety of their apartments, such as conducting temperature screenings, gathering travel history information, and increasing the frequency of cleanliness standards within their offices. Across the globe, companies are adapting to a work-from-home culture. Major firms in the country, alongside a variety of start-ups and tech giants, have urged their employees to telecommute. In addition to self-initiated measures, guidelines set forth by the National Association of Realtors have suggested alternative marketing strategies for realtors, including virtual property tours, e-brochures, and more. Furthermore, visitors are routinely provided with masks to ensure their protection. In conclusion, with recent reports confirming cases of coronavirus in Delhi-NCR and Noida, the real estate industry must prepare for even more significant repercussions than previously anticipated. The risk of infection not only jeopardizes lives, but also poses challenges for property visits and diminishes buyer interest. However, amidst chaos lies an opportunity for growth. The Indian real estate sector, along with allied manufacturing industries, must seek to maintain a positive outlook and pivot towards enhancing production and domestic innovation.

There have been substantial losses evident in real estate stocks following the coronavirus outbreak. (Source: https://www.moneycontrol.com/) Safety Measures Implemented by Builders and Employees for Homebuyers and Workers Amidst such turmoil, traditional real estate practices have become a delicate balancing act, as real estate professionals strive to administer their responsibilities while ensuring the safety of their employees and clients. These measures include enforcing rigorous hygiene protocols within their premises, implementing social distancing, and even canceling events. Many builders have already instituted precautionary steps to ensure the safety of their apartments, such as conducting temperature screenings, gathering travel history information, and increasing the frequency of cleanliness standards within their offices. Across the globe, companies are adapting to a work-from-home culture. Major firms in the country, alongside a variety of start-ups and tech giants, have urged their employees to telecommute. In addition to self-initiated measures, guidelines set forth by the National Association of Realtors have suggested alternative marketing strategies for realtors, including virtual property tours, e-brochures, and more. Furthermore, visitors are routinely provided with masks to ensure their protection. In conclusion, with recent reports confirming cases of coronavirus in Delhi-NCR and Noida, the real estate industry must prepare for even more significant repercussions than previously anticipated. The risk of infection not only jeopardizes lives, but also poses challenges for property visits and diminishes buyer interest. However, amidst chaos lies an opportunity for growth. The Indian real estate sector, along with allied manufacturing industries, must seek to maintain a positive outlook and pivot towards enhancing production and domestic innovation.