Mumbai's housing demand has pivoted toward 1000-2000 sq ft properties as hybrid work, multigenerational living, and suburban growth reshape priorities. Data reveals 68% of Q2 2025 sales in this segment, with developers rapidly adapting layouts and amenities to meet evolving spatial needs across Thane and Navi Mumbai corridors.

Mumbai's elite now prioritize wellness-integrated luxury homes with hospital-grade air purification, bespoke gyms, and Ayurvedic spas. Analysis shows developments like Four Seasons achieved 80% pre-sales, proving health-focused design delivers 15-20% ROI premiums in 2025's market.

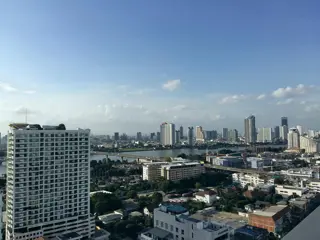

Discover Mumbai's rising micro-markets where infrastructure fuels growth. From Navi Mumbai's airport corridor to Thane's integrated townships, these areas now challenge South Mumbai's dominance with 10-15% annual appreciation potential.

Despite national size growth trends, Mumbai's 500-1000 sq ft apartments command 83% of property registrations. Discover how urban density, budget realities, and smart design sustain compact living dominance in India's financial capital.

Mumbai leads India's real estate digital transformation with blockchain registrations, AI valuations, and virtual reality showcasing revolutionizing property transactions.

Metro connectivity drives 15-20% property price premiums within 500m radius. Coastal corridors face competition as transport-linked micro-markets reshape Mumbai's real estate landscape.

Mumbai's luxury property market surges 85% in H1 2025, driven by NRI investments outperforming London and Singapore with superior returns and currency advantages.

Smart home technology in Mumbai's luxury apartments now features biometric security and AI-powered energy management, becoming essential deal-breakers for premium property buyers.

Complete guide to Mumbai property due diligence covering MahaRERA verification, title checks, developer assessment, and infrastructure impact for safe 2025 investments.

Mumbai's real estate shows stark contrast - luxury properties above ₹5 crore surge 7% while mid-range ₹1-5 crore segment declines, creating unique investment opportunities.

Strategic guide for Mumbai property buyers to optimize stamp duty costs through smart timing, negotiation tactics, and understanding recent market revenue trends.

Infrastructure projects trigger immediate property value surges. Early buyers near coastal roads see 20-30% appreciation as connectivity transforms market dynamics.

Non-resident Indian investments are positioning Mumbai alongside international luxury markets, with $14.9 billion projected by 2025 across prime micro-markets.

Mumbai's rental market undergoes transformation as tenants prioritize larger spaces and wellness amenities, driving luxury location demand with 7-9% growth in H1 2025.

Explore how projected 50-basis-point interest rate reductions will impact Mumbai property buyers, featuring EMI calculations and strategic mortgage optimization tips for 2025.

Essential guide to evaluating Mumbai properties with dedicated workspaces, storage solutions, and connectivity features for successful hybrid work arrangements.

March 2025 stamp duty amendments in Mumbai create historic revenue surge, affecting homebuyers with increased fees and new registration processes requiring strategic planning.

Exploring how Pali Hill, Bandra, and BKC are experiencing unprecedented luxury property demand driven by health-conscious buyers and NRI investments post-pandemic.

Explore Mumbai's emerging satellite towns like Navi Mumbai, Panvel, and Thane offering affordable housing options with robust infrastructure for first-time buyers.

Western suburbs capture 57% of Mumbai's property registrations in 2025, driven by infrastructure development, connectivity improvements, and evolving buyer preferences.

Learn actionable strategies to manage rising construction costs and shifting demand in Mumbai’s volatile 2025 real estate market. Focus on market insights, financial planning, and localized purchasing tactics to maximize returns in this dynamic environment. Key considerations include suburban demand surges, luxury market trends, and government infrastructure initiatives.

Explore actionable strategies to manage mortgage costs amid fluctuating interest rates, including tailored approaches for different loan tenures and Mumbai market insights.

Mumbai's luxury apartments now integrate advanced IoT, AI-driven security and energy-efficient systems, redefining premium living with automated comfort and sustainability. Examination of tech-forward developments and emerging trends reshaping high-end residential markets.

Explore how REITs and fractional ownership enable diversified residential investment in Mumbai through accessible, liquid assets, aligning with 2025 market trends and SEBI regulations. Discover high-yield opportunities while bypassing traditional property management hurdles.

Mumbai’s real estate scene witnesses a paradigm shift as homebuyers prioritize hyperlocal amenities curated dining, boutique cafes, and leisure hubs over traditional location metrics. This seismic change reflects evolving urban aspirations, demanding proximity to specialized services and community-centric infrastructure. Explore how localized experiences now drive property decisions more than...