Learn effective tenant screening methods for South Goa vacation rentals to secure quality guests. This guide covers background checks, damage deposit tactics, behavior rules, and legal safeguards, helping owners minimize risks and boost rental success.

Discover how Bhiwadi is embracing eco-friendly housing through green techniques, pollution-resistant designs, and sustainable communities to combat environmental issues. This article explores innovative solutions for cleaner living in a polluted region.

Discover effective strategies for seasonal rentals near Mysore's cultural landmarks. This article evaluates demand during peak times like Dasara and offers practical tips to optimize properties for maximum tourist appeal and profitability. Learn how to attract visitors with targeted enhancements.

Compare ROI for short-term and long-term rentals in Karaikal, Yanam, and Mahe. Data reveals hidden growth potential beyond tourist hotspots for strategic investors seeking 6-7% yields.

Upcoming infrastructure projects in Surat, including Ring Road expansions, Hazira Port developments, and the Surat Metro, are transforming previously overlooked areas into prime real estate investment opportunities, driving demand for residential, commercial, and industrial properties. Property values in peripheral districts are rising due to enhanced connectivity, with metro lines solving...

Explore how metro expansions, expressways, and infrastructure projects transform Lucknow's real estate landscape, creating high-ROI hotspots. Improved connectivity and smart planning fuel growth in emerging areas like Kursi Road and Jankipuram.

Master the art of negotiating Pondicherry property deals with pro tactics tailored for White Town luxury homes, Auroville plots, and Karaikal commercial spaces.

Explore Surat's booming commercial real estate market through REIT investments, offering fractional ownership, diversification benefits, and stable returns from office assets in India’s fastest-growing city. This guide analyzes Surat’s growth trajectory, REIT advantages, and actionable steps for investors seeking low-risk, high-yield opportunities.

India's real estate is set for a boom, with 17 cities, including spiritual hubs, poised for growth. Government policies, infrastructure, and tourism are key drivers, attracting significant investment and transforming smaller cities into dynamic economic contributors.

Akshaya Tritiya is an auspicious time for real estate investment, especially fractional ownership in commercial properties. This approach offers diversification, accessibility, and higher returns compared to traditional residential investments.

Real estate and stock market investments in India offer distinct advantages. Real estate provides stability and control, while stocks offer liquidity and flexibility. A diversified portfolio can balance these options to achieve financial goals.

Commercial and residential real estate are popular investment choices in India. This article compares both, examining rental income, risks, rewards, and tax implications to help investors make informed decisions.

Residential properties in India cater to diverse needs and budgets. From apartments and villas to plots and builder floors, choosing the right property type is crucial. This guide explores various residential options, investment benefits, tax advantages, and factors influencing property selection.

India's online real estate market is booming, with millions using the internet for property research. Online portals offer convenience, free listings, verified properties, and detailed information, benefiting both buyers and sellers.

Ensure a smooth property purchase by verifying clear title, absence of encumbrances and liens, and a sale deed free of conditions for a secure investment.

This article outlines various additional costs associated with purchasing property, detailing factors like PLC, parking fees, and more, culminating in a final payment estimate.

Navigating India's real estate market requires a skilled agent. Prioritize registered brokers with market expertise, strong communication, and client focus. Verify experience, check client reviews, and utilize online platforms for your search.

This article discusses the essential steps involved in buying a property, including negotiating prices, sale deeds, and the execution process.

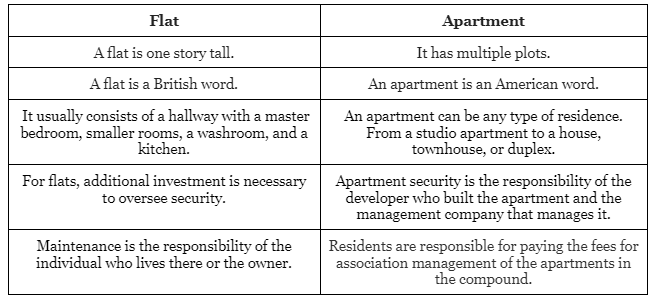

Apartments and flats are often used interchangeably, referring to private living spaces within larger buildings. While "flat" is common in the UK and "apartment" in the US, the terms have nuanced differences based on ownership, luxury, and location. In India, both terms are used, often reflecting...

Tier 2 cities in India are attracting real estate investors due to higher returns, driven by rapid development, job growth, and IT expansion. These emerging markets offer lucrative investment opportunities compared to larger, saturated cities.

Indian real estate prices vary significantly by location, causing confusion for buyers. Prices in cities like Mumbai, Delhi, and Bangalore have seen dramatic increases, with certain areas showing especially wide price bands. This volatility contrasts with more stable Western markets.

India's real estate is booming, with land investments gaining popularity. Buying land offers flexibility for future residential or commercial development. It allows control over designs and provides potential lease income.